Adrian the Lionheart, fighting the good fight against the evil forces of demand, and their rapacious consumption of needed goods and service, wants to save their souls from the heresy of inflation. I’ll leave it up to the reader to decide if Adrian Orr the Lionheart of the Reserve Bank would have been better to stay at home and protect his realm from the few rapacious and wealthy local barons.

Inflation is a problem as it steals savings and undermines the purchasing power of salary and wages, and this worries ordinary people, the lower and middle classes So Mr Orr raising interest rates to deal with inflation must be fighting the good fight? That is, raising interest rates to create inflation, to create a recession, so people have less money to spend. It does have a track record of stopping inflation; because people don’t have money to spend. This inflation fix is based around the theology of neo-liberal economics.

Neo-liberalism chooses this fix because, it wants to protect the supply side of the economy, the producers of goods and services, to protect the sources of wealth and investment that drive the economy.

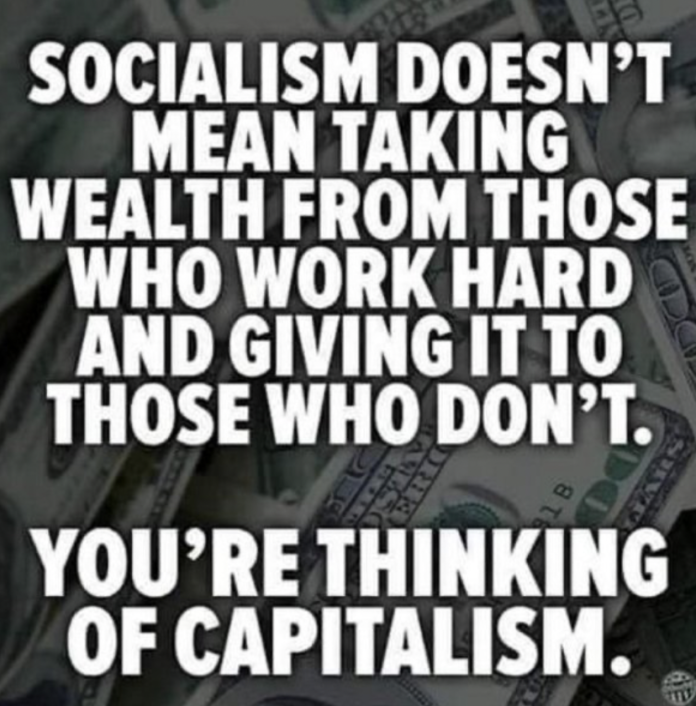

So they rationalise this position – A person commented on one of my previous articles ‘Inflation is an increase in the supply of paper currency, once it enters circulation.’ This is a neo-liberal doctrine. i.e. too much money supply causes inflation. The lower and middle class had too much money because unions pushed up salary and wages, government spent too much money, government gave people too much money. This causes demand and demand causes inflation – cost push, demand pull etc etc.

And this is where the logic of neo-liberalism all starts falling over and it becomes metaphysical.

The neo-liberal protection of the supply side producers only really applies to the large firms. Small businesses supply goods and services to the lower and middle classes. If you raise interest rates to create a recession those classes don’t spend and small businesses fail. Neo-liberalism therefore inherently favours the large established players, (despite all their bullshit talk otherwise). This is a risk to innovation and adaptation within the economy.

The neo-liberals assessment of inflation (too much money causes it) is directly counter to actual observation of the pricing process. A business person has to make a conscious decision to raise the price of a good or service to maximise profit on an item across many transactions. There is no organic market price; it is a decision making process that drives inflation.

Neo liberals are careful not to directly blame demand as the problem for inflation because they know that is the real driver and lifeblood of the economy, but demand expectation is what they want to control so there are not high demands for wages, or for government programmes. Because that will put pressure on raising taxes.

So they blame the money supply as an indirect way to control demand by people. It depersonalises the problem of inflation away from people and projects the problem of inflation onto institutions like unions and governments. Who people can then be trained to blame for inflation.

As importantly, neo-liberals focus on the money supply because they are trying to recreate a de-facto gold standard. A fixed finite resource of money, like the supply of gold was. Why? to secure the wealth for the wealthy supply side of the economy. If there is a tight amount of money then the value of your money will not be eroded. They fear money creation by government as watering down their oh so hard earned wealth.

Neo-liberalism is really political theology dressed in economic drag. Through tautology it creates a sense of laws in economics, like money supply goes up = inflation, but the laws don’t stand up to empirical observation, e.g. 2008 the US Federal Reserve bailed out large banks/corporations by typing extra zeroes behind the numbers; the financial crash was stopped. But no inflation. Massive increase of money supply. Neo liberals say; but it would be if it’s printed money. That’s just soooo lame, e.g. so little cash used in New Zealand.

The inflation New Zealand is currently experiencing is largely imported and it follows the political trends in the US and their inflation is very political. After the Trump election loss the Republican politicians talk of inflation went through the roof as they tried to signal to business to try and create it. Just think of Saudi deliberately not raising oil production to reduce inflation pressures. All political.

But there is a real thing called inflation where prices rise. Covid and supply chain, and Ukraine and oil impacts are real. And these examples show that inflation is way more than just the money supply.

But Labour can’t win an election with inflation and can’t win one with this cure (neo-liberal raising of interest rates to create a recession) . Which is just how this neo-liberal scheme is supposed to work. National and Act can more easily get away with rising interest rates as the hardship it causes is always portrayed as temporary, and they are business people so they know how to make money, so they know how to run the economy, and we will all be better off, just around the corner. Yeah right.

By contrast Labour is supposedly the party of change and compassion. This inflation interest rate rise fix just doesn’t align or promote the Labour brand; so voters think why not vote for the others. Why Labour has gone along with neo-liberalism for so long reflects a lot of poor quality middle of the road leadership lacking in strategic insight.

There are many ways to control inflation that aren’t political theology, but I’ve written too much.

But Adrian the Lionheart, it’s not your personal fault. The great enforcer of Neo-liberal economic theology. Your neo-liberal banner looks so big and grand – don’t worry abut the resulting family arguments over money, the separations, domestic violence, scared or hungry children, the suicides, those with depression, the mental health impacts, the poor quality food or products brought, the sleeping in cars.

It’s all in a good cause.

Source link

Author: Stephen Minto